Updated: 12/28/2018 | December 28th, 2018

The best way to travel when you don’t have any money is to take money out of the equation. OK, not completely. While you can travel really, really cheaply, some money is required (unless you want to go hobo-style like this guy, in which case, this article isn’t for you).

But, assuming you don’t want to do that, you are going to need some money for travel. But you don’t need as much as you think you do, especially if you work to make your two biggest expenses — accommodation and flights — virtually free.

How?

By travel hacking.

I’ve written about it before, but I’ve never really broken down how I earn all those points and miles and redeem them for the business-class flights you always see me enjoying on Instagram. In this post, I’ll go into detail and provide the step-by-step breakdown of exactly what I do to earn around one million points a year — all without traveling! (When you add in the miles and points I get from traveling, it’s well over a million per year!)

This is going to be a long post, so get your coffee ready.

First, a refresher: travel hacking is the art of collecting frequent flier, hotel, and credit card points and airline miles and redeeming them for free travel. But it’s not about spending lots of money — the idea is to “hack the system” and use rewards programs against themselves to get lots of points and miles without spending a lot of money or traveling a lot. You leverage these systems to your benefit.

And it’s not just for Americans — Canadians, UK residents, Australians, Kiwis, and Spaniards can work these systems in their favor. (In reality, anyone can, but it’s just easier if you’re in these countries. So, while I will use the American market as an example, as that is the one I have access to, the principles and strategies I use can apply to you. Just substitute your local cards and programs for mine!)

One quick note before we begin (especially to the travel hackers reading this): in the travel hacking world, my mileage earning is pretty small. I know people who earn multiple millions of miles a year doing what I do (and a few other things), but I value my time, so why spend time earning miles I don’t need? My mileage needs are taken care of. I don’t waste time getting miles I don’t need.

Miles also lose value over time as airlines change their earning and burning rules, so I would rather have what I need and not waste time getting something with a decreasing value. Miles aren’t money.

Some people do this for the love of the game; I do this because I’m cheap and want to pay for as few flights and hotels as possible.

Here’s how I get those points and miles:

Step 1 – Sign up for credit cards

Credit cards are the tool through which you run your money in order to accumulate your points and miles. Think of them as the points-and-miles printing press. You can earn points and miles without them, but the process takes a lot longer and is a lot harder. To make this work, you will need a credit card.

When used properly, credit cards are smart financial instruments. You can earn hundreds of thousands of miles per year that enable you to travel for free (and they offer better purchasing protection than your debit card). Simply having them won’t send you into debt or cost you high-interest rates. Just make sure not to spend more than you have and to pay off your bill each month.

So the first thing I do is apply for a bunch of these credit cards. But I don’t do it willy-nilly. I have a goal in mind.

As a crazy travel hacker, I have more cards than the average person needs, but I always apply for new cards to reach a specific goal. Be sure to do this: think about the trip you want to take, where you want to stay, and how you want to get there, and then get the cards that help you get there.

If I’m low on American Express points, I’ll look for a new American Express card. If I want to go to Iceland, I’ll sign up for an Alaska Airlines card because I can use those miles to book a rewards ticket to Iceland thanks to their partnership with Icelandair. Moreover, I always look for what card offers the highest bonuses, even if I don’t need those points right away.

What have I signed up for this year? In the last six months, I applied for the following cards:

- IHG – I don’t stay in hotels often, but I use hotel points for any last-minute stays I need or for conferences when I don’t want to stay in hostels. Since I’d never held this card before, I got the 65,000-point bonus.

- American Airlines Platinum Business Card – Though I fly AA often and earn their miles easily, it had been a while since I had this card, so I applied again for a 50,000-mile sign-up bonus.

- American Airlines personal card – Same as above.

- Alaska Airlines personal card – Since Bank of America lets you cancel and sign up for this card again and still be eligible for the bonus, I sign up for this card every 2–3 months. This got me 25,000 miles.

- American Express Everyday card – They ran a 25,000-point promotion so I finally got this card, as the normal bonus is 15,000 points.

- Chase Ink Bold – When they offered a recent 60,000-point sign-up bonus, I applied for this business card as my charity FLYTE’s card.

Total points earned: 275,000

One thing to note about credit cards is that you can’t just sign up, cancel, and sign up again. Many card companies make you wait 18–24 months before you become eligible for a sign-up bonus again. (American Express only lets you earn the bonus once per card per lifetime!) I cycle through cards on a multiyear basis.

Therefore, I try to space out my sign-ups. I do two or three big credit card sign-up frenzies per year. This allows me to meet any minimum spending requirements (see below), allows the temporary dip the application causes in my credit score to go away, and gets me around any red flags the credit card companies have. For example, if issuers see you have applied for a ton of credit cards lately, they are less likely to approve you. Chase has something called the 5/24 rule, which states people who’ve applied for more than five cards within a 24-month period can’t get a new card from them. I’ve heard mixed reports on this, though — sometimes it catches people, sometimes it doesn’t.

Moreover, despite popular belief, having a lot of credit cards won’t hurt you. In fact, it can help you. Outside of your payment history, your utilization is the next most important factor in your credit score. Don’t worry about anything else. If you have $100,000 in available credit but only are using $5,000, that’s better than only having $5,000 in credit and using it all every month. Having more cards can actually help your credit score because of the better utilization ratio they create.

Here’s a list of credit cards you can sign up for!

Step 2 – Meet the minimum spending requirements

Each of these cards comes with a minimum spending requirement before you can earn that bonus. You just don’t get it for nothing. That meant I had to spend $11,000 in three months in order to meet the requirements and earn my bonuses! (The Alaska Airlines card comes with a fee of only $75 and no spending requirement so I essentially just bought 25,000 miles for 75 bucks.)

Here’s how the cards broke down:

- IHG: $1,000 minimum spend

- AA business card: $3,000 minimum spend

- AA personal card: $3,000 minimum spend

- Alaska Airline: none

- American Express: $1,000 minimum spend

- Chase Ink business card: $3,000 minimum spend

But my everyday spending isn’t anywhere close to that.

Since the purpose of travel hacking is to not spend extra money (you should absolutely not go into debt for this), I had to figure out ways to meet those spending requirements without incurring extra debt. Here’s how I did it:

- In the US, you can pay your federal tax bill on a credit card for a fee of 1.87%. I don’t pay all my taxes during the year so that at the end of the year, I have to pay them in one large chunk. I then time that tax payment with a credit card sign-up so I can get the bonus. Yes, there is a fee, but if you work out the math, it’s worth it. That took care of a big chunk.

- I time my purchases and sign-ups. If I have to move, buy furniture, need a computer, or join a gym, I sign up for a card and then charge my big purchases to the card.

- I go out to dinner with my friends, pay, and ask them to reimburse me. I used this technique in Las Vegas, and that took care of the entire minimum spending for the Amex Everyday card. This is especially easy with apps like Venmo nowadays, where they can reimburse you easily at the exact moment of payment.

- I ask friends and family if I they have a big purchase they wouldn’t mind letting me put on my card. This doesn’t always work, and it isn’t always needed, but often friends and family will let me put it on my card as a favor, and then they’ll pay me instead of the store.

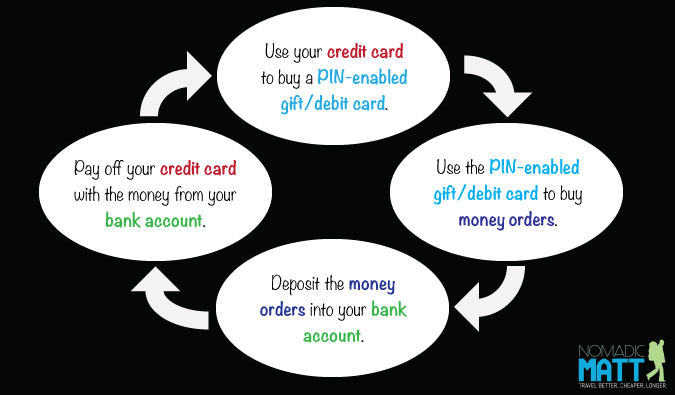

- I manufacture spending for the remainder. This is when you move money around so that you artificially create spending through gift cards and money orders. You can buy pre-paid debit cards, turn them into money orders, put those money orders in your bank account, and then pay off your credit card. You have to pay a fee for the cards and money orders, but when doing this for sign-up bonuses, it’s worth the cost. I purchase pre-paid debit cards in $500 increments.

Note: As I incur a lot of business expenses, it’s easy for me to meet the minimum spending requirements for business cards (for the Chase Ink business card, we met the spending requirements by paying expenses for the charity). The steps outlined above were used for the personal cards.

Total points earned: 25,000 (21,000 in spending, plus category bonuses [see below] on food and office supplies; my tax bill represented half my spending)

Step 3 – Be smart with spending

Get category bonuses

In the movie Up in the Air, George Clooney’s character never wastes an opportunity to earn points. I’m the same way. I never, ever, ever just earn one point per dollar spent if I can get 2, 3, or 6 points per dollar spent.

Certain cards have what are known as category bonuses, where you receive 2–5 points per dollar spent. It varies by card, but generally, you get 2 points on restaurants, 2–3 on airfare, and 5 on office supplies. Here’s a list of the cards I use regularly and their spending bonuses:

- American Express EveryDay Preferred: 3 points per dollar spent on groceries (up to $6,000 annually)

- American Express Premier Rewards Gold: 3 miles per dollar spent on flights

- Citi ThankYou Premier: 3 points per dollar spent on groceries; 2 points per dollar spent on hotels

- Chase Sapphire Preferred: 2 points per dollar spent on food

- Chase Ink Bold: 5 points per dollar spent at office supply stores or business expenses (up to $50,000 annually); 2 points per dollar spent on hotels

For example, if I am buying an airline ticket, I’ll use my American Express Premier Gold and get 3 miles for every dollar I spend. I buy gift cards at Staples on my Chase Ink card to get 5 points per dollar spent. I pay my cellphone on that card too!

Why get one point at a time when you can get five?

But there are also a few other ways to get bonuses, too:

Use airline shopping portals

All airlines, hotels, and travel brands have preferred merchants. These companies — ranging from clothing retailers to sporting good stores to office supply businesses and everything in between — partner with airlines’ (hotels’, etc.) special shopping malls. By ordering online through these malls, you can earn additional points.

You can use Evreward or Cash Back Monitor to discover the current best deals across various programs. Simply type in the merchant or product you want, and it will compile a list of bonuses the various point programs are offering at that moment so can you maximize the programs to purchase from.

Say, for example, you want new clothes from the Gap. Going into the Gap store gets you one point per dollar spent. By using Evreward, you can see that by going the United shopping portal, signing in, clicking the link to Gap, and purchasing online you can earn three points per dollar spent. Suddenly, you get 300 points instead of 100 for your $100 shopping spree!

Shopping portals 2.0

While purchasing online is great and can lead to earning multiple points per dollar spent, you can stack offers to get double and triple the amount of points! For example, if you go to Sears through American Airlines’ portal and buy a $100 gift card, you get three AA points per dollar spent. Go back through the portal to use the gift card for $100 in merchandise and get another three points for total of 6 points for $100 spent. This way you earn 600 AA points instead of the 300 you would have gotten if you had just made your purchase directly through the online portal in the first place. Remember, if you just walk into a Sears store, you’ll only get 100 points for that $100 USD purchase!

So if I used my AA credit card, I would get 700 points total (600 in bonus points plus the 100 from spending) or I could get 600 AA points and 100 Chase points if I used a Chase card.

Dining rewards programs

Just like shopping portals, airlines also have dining rewards programs. You sign up with your frequent flier number, register your credit card, and get extra points when you dine at participating restaurants in the airline’s network (which rotate throughout the year). It’s important to note that while you can sign up for every program, you cannot register a credit card with more than one. That means that if your Chase Sapphire Preferred card is tied to your American Airlines account, you can’t earn miles on your United Airlines account with that same card.

Join one of the programs in the Rewards Network (they run all the dining programs) so you can get five miles per dollar spent once you became a “VIP member,” which happens after 12 dines. So if you get those 12 under your belt (so to speak) early in the year, for the rest of the year you’ll be racking up five points per dollar spent!

A note on keeping track of all this: As I was writing this post, I went to dinner with a few friends. My buddy Noah was like “This is too much to keep track of.” That’s a common feeling among people looking to start travel hacking. However, it appears more complicated than it really is. Once you know what cards give you what bonuses, the next step is to simply use the cards that get those bonuses and meet your goals.

For example, as I mentioned above, all my airfare goes to my American Express Gold card. I get three miles per dollar spent, and this is what provides a bulk of my yearly AMEX points. For restaurants, I use Chase Sapphire since I get 2 points per dollar. For online shopping, I tend to go to AAdvantage shopping portal as a way to “juice” my AA account.

You never want to spread yourself too thin, though: having points all over the place will lead you to having low point balances in multiple accounts. I tend to stick to just a few accounts with my everyday spending: Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou points because they are all transferable to other airlines and hotels. (Note: Since I mostly fly American, I don’t worry about building miles in that account as I get them through flying. Most of my business expenses go to Starwood SPG so I don’t worry about building a balance there through personal spending.)

Total points earned per year: roughly 150,000 (spending and bonus category dependent)

Want to Learn How I Travel the World for Free?

Stop paying full price! Download our free guide to travel hacking and learn:

Stop paying full price! Download our free guide to travel hacking and learn:

- How To Pick a Credit Card

- How To Earn Miles for Free Flights & Hotels

- Is Travel Hacking Really a Scam?

GET THE FREE GUIDE

Step 4 – Rinse and repeat on the manufactured spending

There are some people in the travel hacking world who manufacture spending like it’s their job. I have a friend who processes $10-20,000 a month in gift cards. That’s too much work for me. I’m busy and don’t feel like putting that much effort into it. However, I do a small amount of this in order to “juice” my point accounts, especially those with category bonus at Staples via my Chase Ink card that help offset the $4.95 fee per card. Here’s a diagram of how this works:

I don’t do this every month (you can’t do it while traveling) but this helps me offset minimum spending requirements on cards and earn a few extra miles each year.

Total points earned per year: 150,000

(Note: I use my Chase Ink business card a lot at Staples. I buy Amazon, iTunes, and restaurant gift cards to be sure I maximize the 5 points per dollar spent bonus. The number above reflects not only the manufactured spending I do but the gift cards I buy too.)

Step 5 – Sign up for every contest, survey, and deal in the world

Airlines and hotels often offer points and bonuses for signing up for a deal, taking a survey, filling out a form on Facebook, etc. The points here are small (100-1,000 at a time) but over the course a year they can add up. United recently gave 1,000 miles to people who signed up for their dining program. American Airlines gave you 350 miles just for entering a contest to win more miles!

Moreover, I also use the E-Rewards survey program. Every day they send me surveys via email and if I have time, I fill them out. They take 5-20 minutes each. Each completed survey is worth a certain number of “e-dollars” that can be redeemed for points on a number of programs:

Point redemptions vary but $100 in e-rewards money equals 2,000 AAdvantage miles.

Total points earned per year: 25,000

Step 6 – Buy points/miles… sometimes

Airlines and hotels sometimes offer really good deals for points/miles and, if I know I am going to use them soon, I’ll buy them at a discount. This basically lets you buy flights for cheaper than booking them. For example, Lifemiles (Avianca’s membership program) often does a promotion where you can get a 135% bonus on bought miles. If you max the promotion out, you usually get 352,000 miles for around $4,900, but at that rate, you’re buying miles for 1.4 cents per mile, which is an amazing deal. (The closer you get to 1 cent per mile, the better the deal! Follow websites like View from the Wing or One Mile at a Time and they alert you to all these point offers, break it down, and basically tell you if this is a good deal or not.)

It may sound crazy to spend that much money on miles (and you certainly don’t need to do it at all), but let’s put it in perspective. For 90,000 miles, you can book a one-way first-class flight from the US to Asia. Since you spent 1.4 cents per mile, that ticket works out to be $1,260. Not too bad for a first-class ticket, huh?

Buying points and miles is a way to pad your balance and buy tickets at a steep discount. I do this sometimes if I’m traveling soon and know I’m going to paying for the ticket anyways (I don’t always use miles when I travel). It’s not free, but I would rather buy a first-class ticket for $1,260 than an economy ticket for the same price.

Sometimes travel hacking is about finding value and doing a bit of arbitrage to get more for less!

Points earned: 100,000 points

Step 7 – Cancel cards I don’t use

Airline cards have fees, so when the yearly fee comes due, I’ll cancel the cards I don’t use or that don’t have a benefit to me. For example, the British Airways card: I used it for the sign-up miles and was done with it. It was canceled. The Hyatt card? It has a $75 yearly fee but it comes with two nights free each year. That’s two nights in a hotel for $75. I keep that one. The American Airlines personal card? One of the benefits is 10% miles back on redemptions, so if I redeem for 100,000 miles each year, I get 10,000 miles put back into my account — well worth the $95 annual fee.

Canceling cards doesn’t hurt your credit score. Old credit lines help, which is why I keep my Discover, Capital One, and a few other cards around. They have no fees and high limits so they anchor my credit. As I said before, what is important is your overall debt-to-credit ratio. So canceling a few cards lowers that ratio, but if I have no debt it doesn’t matter.

Moreover, I also transfer the credit lines to other cards with that card company so that I don’t lose the credit (and that doesn’t even make a mark on my credit score, let alone a dent!).

Step 8 — Get a second round of credit cards

Twice a year, I go on a big credit card splurge and start the cycle again. I’ll look at what I canceled and what I need. Since many operators require a waiting period between bonuses, I’ll aim for cards I haven’t had in a long time as well as which have another sign-up bonus.

Then after I get the new cards, I’ll repeat step 2 to meet any minimum spending requirements.

Total points earned: 200,000-300,000

Total points earned: roughly 975,000 per year ± 50,000

(The above tricks don’t count all the miles I earn via business expenses, which add up to an additional couple hundred thousand miles a year, putting me well over one million miles earned.)

A lot of this stuff depends on time and effort. If I got more credit cards, I could earn more. If I spent more money, I could earn more. I just don’t care enough. I have more miles than I need. I fly my team around on miles. I fly myself anywhere miles. I give miles to my mom.

By using the eight steps outlined in this article, the sky is the limit on how many miles you can earn. It just depends on how much you want to ramp up each step. As I said before, my million miles per year is a small number compared to some of the other travel hackers out there.

It is possible to earn more miles than you will need to travel and fly for free. Even if you travel only once a year, just want to visit your parents, or aspire to take your family on one trip, you can do it.

Travel hacking doesn’t have to be complicated. It’s simple and accessible to everyone.

The Ultimate Guide to Travel Hacking

For more information on how to earn points and miles that you can use toward free travel, check out The Ultimate Guide to Travel Hacking. This book shows you exactly how to take money out of the travel equation and use frequent flier programs to get free flights and hotel rooms. The strategies in this book will get you out of your house faster, cheaper, and in comfort.

For more information on how to earn points and miles that you can use toward free travel, check out The Ultimate Guide to Travel Hacking. This book shows you exactly how to take money out of the travel equation and use frequent flier programs to get free flights and hotel rooms. The strategies in this book will get you out of your house faster, cheaper, and in comfort.

Click here to learn more and start reading it today!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner or Momondo. They are my two favorite search engines because they search websites and airlines around the globe so you always know no stone is left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld as they have the largest inventory. If you want to stay somewhere other than a hostel, use Booking.com as they consistently return the cheapest rates for guesthouses and cheap hotels. I use them all the time.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. I’ve been using World Nomads for ten years. My favorite companies that offer the best service and value are:

- World Nomads (for everyone below 70)

- Insure My Trip (for those over 70)

Looking for the best companies to save money with?

Check out my resource page for the best companies to use when you travel! I list all the ones I use to save money when I travel – and that will save you time and money too!

Photo credit: 1

Updated: 08/17/2018 | August 17th, 2018

Updated: 08/17/2018 | August 17th, 2018 Long-time readers know I love travel credit cards because of the huge amount of points and perks they bring. (New readers now know this.) In fact, this month alone I signed up for an Amex Platinum (50,000 points) and United Airlines card (60,000 points), with more sign-ups planned next month. Points bring lots of benefits like free flights, elite status, free checked bags, and priority boarding. And, while I know a lot about this subject, there are people who spend their whole day figuring out how to maximize points. People like Brian Kelly.

Long-time readers know I love travel credit cards because of the huge amount of points and perks they bring. (New readers now know this.) In fact, this month alone I signed up for an Amex Platinum (50,000 points) and United Airlines card (60,000 points), with more sign-ups planned next month. Points bring lots of benefits like free flights, elite status, free checked bags, and priority boarding. And, while I know a lot about this subject, there are people who spend their whole day figuring out how to maximize points. People like Brian Kelly.